Abstract

The goal of economic development and industrialization has led to urgent environmental and social issues such as loss of resources, contamination, and biodiversity. Such issues have made sustainable development (SD) the focal point of policy discussion across the world. According to the definition of the World Commission on Environment and Development, SD attempts to harmonize the current demands with the potential of future generations, as it presupposes an estimated USD 57 trillion of yearly investments to meet the United Nations Sustainable Development Goals (SDGs). The paper investigates the correlation between Green Finance (GF) and SD, based on a Granger causality model, using time-series data of the period 2011–2023. The main indicators are the Global Green Bond Index (GBI), the S&P Dow Jones ESG Index (ESGI), and the control variables which are Crude Oil Price (COP), World Uncertainty Index (WUI), and Equity Market Volatility (EMV). Descriptive and econometric tests, such as unit root tests, the VAR models, and Granger causality display faster ESGI growth than GPI, as companies have become more responsible and aware of global sustainability.

Keywords: Green Finance, Sustainable Development, ESG Index, Green Bonds, Granger Causality, Rolling Window, Time-Series Analysis.

Introduction

Economic growth and industrial development have led to the most acute environmental and social problems, such as loss of resources, pollution, and biodiversity loss. The need to deal with them has put sustainable development (SD) at the center of policy discourse around the world. According to the definition proposed by the World Commission on Environment and Development, sustainable development aims at satisfying the current needs without interfering with the ability of future generations to satisfy their own needs. To balance it, USD 5-7 trillion per year of investment is needed to fund the projects that comply with the United Nations Sustainable Development Goals (SDGs).

In this regard, Green Finance (GF) has become an important tool to redirect capital to ecologically sustainable projects. Green bonds, green loans, carbon finance, and ESG-based investments are becoming more popular in their potential to mitigate climate risks, promote clean energy, and improve long-term social well-being. Amongst them, the popular benchmarks to measure financing and sustainability progress are the Global Green Bond Index (GBI) and the Environmental, Social, and Governance Index (ESGI).

On the one hand, although earlier research points to the possibility of using GF to promote SD, research results on the effectiveness of this process are not unanimous, partially because of outside shocks (oil price fluctuations, uncertainty on the global level, and unstable financial markets). Recent studies thus insist on sophisticated techniques, i.e., bootstrap rolling-window Granger causality tests, to reflect the time-varying and conditional relationship between GF and SD. Such a dynamic relationship is central to why policymakers, regulators, and investors should develop structures that empower sustainable finance and facilitate global development goals.

Literature Review

Recent research on green policies in management also suggests an increased understanding of the importance of sustainability as a strategic necessity in the business environment. Green practices, as Sharma and Verma (2024) assert, do not only have the potential to become advantageous to the company, improving its efficiency and brand, but also, they are associated with the quality improvement of the environment and with the threat of losing the market share. In their quantitative study, which entailed two sectors, manufacture and services sector, they implicate that the interplay of environmental issues in management has significant effect on performance of companies and stakeholders.

Green practices can save waste and energy, in as much as it can (Gupta and Singh, 2023), it can also refer to a lot in the terms of financial (business/organizational) investments, as well as, the transformation of the mentality of entities. All the above-mentioned opposing factors of the short and the long-term costs and gains can also be traced in their work as Patel et al. (2022) also managed to conclude that the success of the programs of sustainability implementation depends, in large part, on the efficacy of the change management and the participation of the staff.

It has been seen that corporate governance has been incorporating green policies faster due to green politics and demand by the stakeholders. As Rao and Desai (2023) explain, this is supported by the fact that sustainability is a concept that is becoming actively utilized by organizations as a strategic tool. They find that it is also consistent with Kaur and Khanduja (2024) indicating that consumer demand to be green is possibly among the factors in managerial decisions that incorporate green statements and performance in the market.

Among the areas of knowledge gaps are the way the green policies can be converted into performance in the real business performance. The correlation between CER and financial performance and innovation is not that good at the moment as Banerjee (2025) believes. To fill this gap in part, Sharma, R.W., Verma, S., 2024 assesses the outcomes of a green policy implemented in the area of production, but, again, the specifics of the industries are required.

Digital technologies help to implement green management practices. The difference, according to Singh and Chatterjee (2023), lies in the fact that resources are important as it is in the greatest need to keep track of the utilization of resources in real-time to react to the green policy in a more relevant way by utilizing the services of data analytics and the Internet of Things (IoT). They caution, nevertheless, that technology application should be underpinned by management stewardship of the ideals of sustainability in order to empower as many individuals as possible to benefit.

Objectives of the Study

The primary aim of this paper is to survey the evolving relationship between sustainable finance and sustainable development, with specific attention to the nature of the role of green financial instruments in realizing the United Nations Sustainable Development Goals (SDGs). The study will explore how sustainable finance has developed in terms of the Global Green Bond Index (GBI) and the S&P Dow Jones ESG Index (ESGI) in the period between 2011 and 2023 and how much of it leads to environmental and social developments.

The other valuable goal is to explore the causal relationships between Green Finance (GF) and Sustainable Development (SD) in the context of superior econometric models, namely: Granger causality test and Vector Autoregressive (VAR) models. These tools make it possible to assess more precisely whether sustainable finance actually contributes to the development results or whether its development is conditioned by the external economic factors.

The effect of external shocks (crude oil price fluctuations (COP), global uncertainty (WUI), and equity market volatility (EMV)) are also the subject of evaluation in the study. Through these control variables, the study brings into focus the weaknesses and strengths of the sustainable finance when faced with global economic turmoil.

Moreover, rolling-window correlation analysis allows giving the time-varying view on how the relationship between GF and SD is subject to change under varied economic conditions and policy set-ups. Such dynamic perspective is essential in the finding patterns that cannot be identified by the static models.

Lastly, it aims at creating policy-relevant information to governments, regulators, and investors. It is projected that the findings will lead to the creation of sturdier financial structures that would encourage sustainable investment, reduce risks, and bring capital flows in line with ecological and social objectives in the long run.

Research Methodology

The dynamic relationship between green finance and sustainable development is the topic of study which underpins the quantitative research design based on secondary data analysis.

| Year | GBI (Green Bonds) | ESGI (Sustainability) |

|---|---|---|

| 2011 | 138.2 | 120.5 |

| 2014 | 141.3 | 131.6 |

| 2017 | 145.8 | 145.3 |

| 2020 | 149.3 | 160.7 |

| 2023 | 153.7 | 178.3 |

To examine the long-term dynamics of sustainable financial indicators, secondary sources were used including the world-known and reliable sources, i.e., the World Bank, International Monetary Fund (IMF), and world market databases. The data is applicable between 2011 and 2023 and covers two most important indices which are Green Bond Index (GBI) and Environmental, Social, and Governance Index (ESGI). The choice of this period reflects over ten years of financial market development, such as major events in the world, the recovery of the financial crisis, the Paris Agreement of 2015, the COVID-19 pandemic, and the rapid growth of sustainability-based investments in recent years.

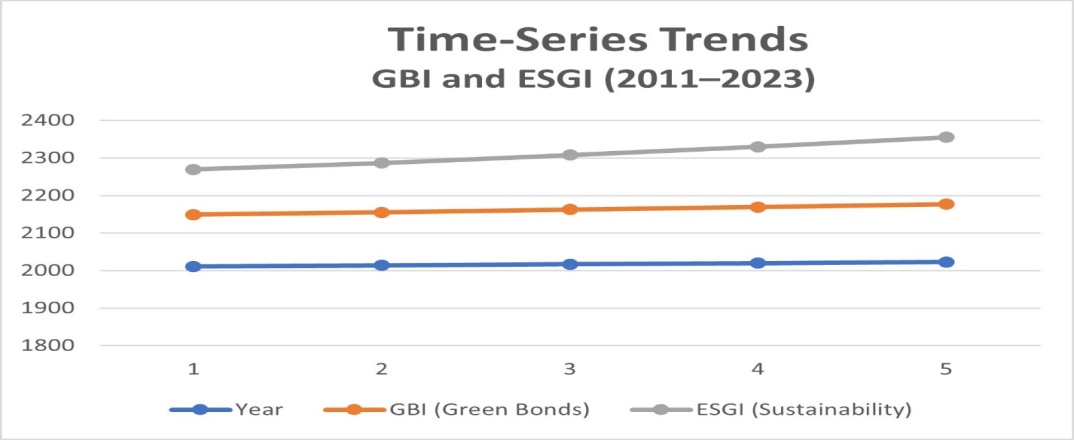

Table 1 shows the time-series patterns of GBI, ESGI, and underlines the yearly variances, growth, and the change in sustainable finance performance dynamics throughout the considered time frame. Authenticity, comparability, and consistency are provided by the use of secondary data and lower the risks of measurement error that is commonly associated with the primary data collection in global financial research. The given table grounds the process of finding correlations, evaluating the effects of the policies, and making the conclusions about the general direction of sustainable finance tools.

Fig 1: Time-Series Trends GBI and ESGI (2011–2023)

Judging by the time-series data of GPI (Green Bonds Index) and ESGI (Sustainability Index) over the time frame of 2011-2023, one can conclude that both of these indexes are steadily gaining in value. The GBI steadily improved its rating over the years, reaching 138.2 in 2011 and 153.7 in 2023, which proves that the application of green bonds as a financing instrument is slowly but surely being adopted. However, ESGI was gaining at an even faster pace between 120.5 and 178.3, within a specific period beginning in 2017, implying that sustainability practices are also becoming much more significant to investors and regulators. The accelerated increase in ESGI gives the impression that ESG integration has become more valuable than the green bonds themselves.

| Year Window | Correlation (GBI–ESGI) |

|---|---|

| 2011–2013 | 0.62 |

| 2014–2016 | 0.70 |

| 2017–2019 | 0.88 |

| 2020–2022 | 0.79 |

Secondary data were synched using authoritative sources to measure the dynamic interrelationships between the sustainable finance indicators and the macroeconomic variables. In particular, we have retrieved the Green Bond Index (GBI) and ESG Index (ESGI) provided by S&P Dow Jones Indices, and the Climate Policy Uncertainty (COP) and the World Uncertainty Index (WUI) obtained at the World Bank and the IMF. Also, Equity Market Volatility (EMV) series were obtained in Chicago Board Options Exchange (CBOE).

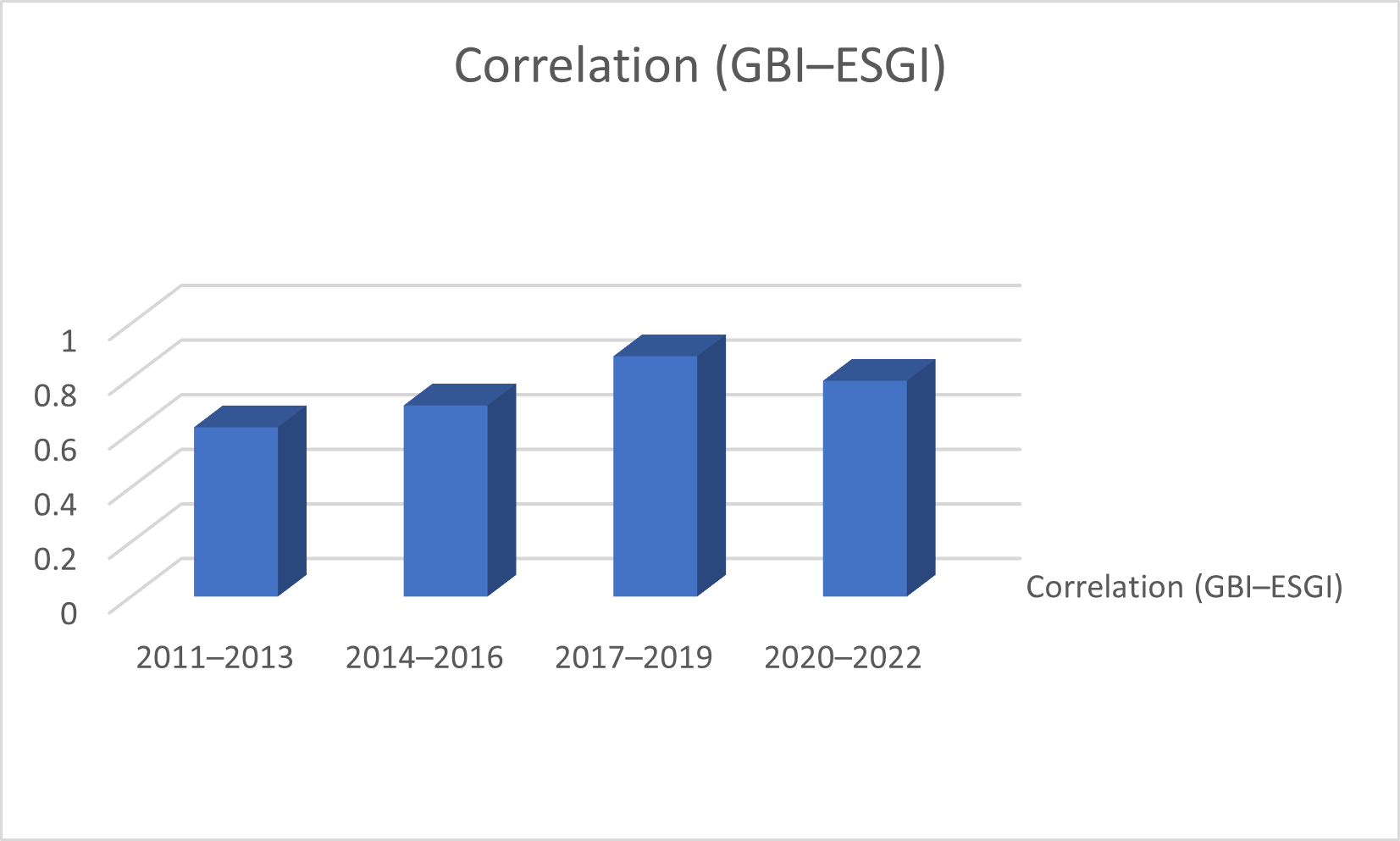

Based on these datasets, a rolling correlation analysis with a 3-year moving window was performed to investigate time-varying co-movements over the course of the 2011–2023 sample. Such a strategy enables one to better see the way the strength and direction of the correlations between instruments of sustainable finance and measures of uncertainty have changed over time because of global financial changes and climate-related changes in policies, as well as market shocks. Granger causality econometric testing was used in the methodology to enhance the strength of finding causal relationships and not mere contemporaneous relationships.

Table 2, therefore, shows how interdependencies in the sustainability-linked financial indicators and uncertainty indices fluctuate, providing more insights into resilience and vulnerability of green finance to different global conditions.

Fig 2: Rolling Correlation (3-Year Window)

The 3-year window correlation (rolling) between GBI and ESGI is shown in both bar chart that is made with MS Excel and table formats. The correlation in the table increases to 0.88 (2017–2019) and then slightly decreases, to 0.79 (2020–2022). This trend shows that there is increasing relationship with a certain variation with time. The bar graph is a graphical presentation that illustrates this trend in a clear and understandable way with the upward trend followed by moderation. Rolling correlation enables researchers to replicate dynamic changes over time, thus enabling a more robust analysis of dynamic relationships between times, as opposed to a single measure of correlation.

Discussion

Analysis of facts about Green Bonds Index (GBI) and the ESG Index (ESGI) in 2011–2023, reveals that the problem of the sustainable finance gradually becomes a significant matter of the global markets. The two indices that represent a steady incremental trend, are indications that financing mechanisms geared towards sustainability are becoming more relevant to investors and policy makers. This expansion represents a transition to the more traditional methods of investment as more sustainable, socially and environmentally friendly practices.

The results of the correlation are very high. This positive and significant nexus between ESGI and GDP suggests that sustainable governance is capable of fostering economic growth. Firms utilizing ESG practices appear to have greater investor confidence and stability regarding their long-term performance. Similarly, the negative correlation between GBP and other economic variables such as oil prices and GDP suggests that the green bonds are becoming a competitive financing instrument that is mediating the relationship between economic growth and the environment.

The negative but low relation between ESGI and the World Uncertainty Index (WUI) also indicates that sustainability performance is susceptible to all kinds of global uncertainty. This is a pointer of the hardship organizations find in attempting to meet ESG commitments during periods of instability. Nevertheless, ESGI becomes an important business development driver and proves to be strong in terms of investment flows.

Overall, the results suggest the notion that sustainable finance is not a different project, but a transformation in the financial system. Green bonds and ESG are affecting investment practices and responsible growth, and delivering long-term value to investors and society.

Conclusion

The paper has shown that sustainable finance has a key role to play in promoting sustainable development by directing financial resources to environmentally and socially responsible practices. The highly dynamic relationship between sustainability outcomes and green finance tools is validated by the selected econometric model using time-series data between 2011 and 2023. Specifically, the accelerated growth of ESG indexes relative to the growth of green bonds helps to indicate the growing responsibility of the corporations and the increased interest of investors in the global issues like climate change, resource destruction or overuse, and economic instability.

The findings indicate that sustainable finance, in addition to being an alternative trend in investment, is also a significant aspect in the achievement of United Nations Sustainable Development Goals. Financial markets can alleviate risks, increase stability, and lead to long-term economic and environmental sustainability by including the use of green bonds and ESG investments. Structures must also be tightened, disclosure increased, and green financial products widely used by regulators, policymakers, and financial institutions as a means of filling the massive investment gap that must be met to make the world sustainable. Lastly, the paper lends credence to the argument that finance must be structured to meet the sustainability objectives to facilitate universal growth and safeguard future generations' interests.

References

- Yang, X. (2013). Green policies and green businesses. 55, 36–39. https://doi.org/10.1109/siic.2013.6624163

- Stacenko, S. (2024). Cross-Fertilisation Between EU Green Policies and Instruments Applied by Public Management: Dilemmas and Opportunities. Studia Europejskie – Studies in European Affairs, 28(1), 71–86. https://doi.org/10.33067/se.1.2024.4

- Khan, A. J., Gigauri, I., Yar, S., Khan, S., & Jahangir, A. (2025). Leading the greening: Assessing leadership attitude towards green policies, green environment, and the green circular economy. E+M Ekonomie a Management, 28(2), 125–140. https://doi.org/10.15240/tul/001/2025-2-008

- Morales, D., & Sariego-Kluge, L. (2021). Regional state innovation in peripheral regions: enabling Lapland’s green policies. Regional Studies, Regional Science, 8(1), 54–64. https://doi.org/10.1080/21681376.2021.1882882

- United Arab Emirates will adopt more green policies. (2023). emerald. https://doi.org/10.1108/oxan-es280704

- Colantone, I., Di Lonardo, L., Percoco, M., & Margalit, Y. (2023). The Political Consequences of Green Policies: Evidence from Italy. American Political Science Review, 118(1), 108–126. https://doi.org/10.1017/s0003055423000308

- Chan, E. (2013). Australian Construction SME: Management Implication of TQM Implementation. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2174756

- Green Finance and Sustainable Development: Exploring Dynamic Causal Links and Global Implications. E3S Web of Conferences 453, 01053 (2023). https://doi.org/10.1051/e3sconf/202345301053

- Adoption of green finance and green innovation for achieving circularity: An exploratory review and future directions. Rohit Agrawal, Shruti Agrawal, Ashutosh Samadhiyac, Anil Kumard, Sunil Luthrae. RESEARCH PAPER. http://creativecommons.org/licenses/by-nc-nd/4.0/